The Golden Mile: Suriname’s Rise in the Oil and Gas World

UP NEXT: Suriname’s Economic Revolution

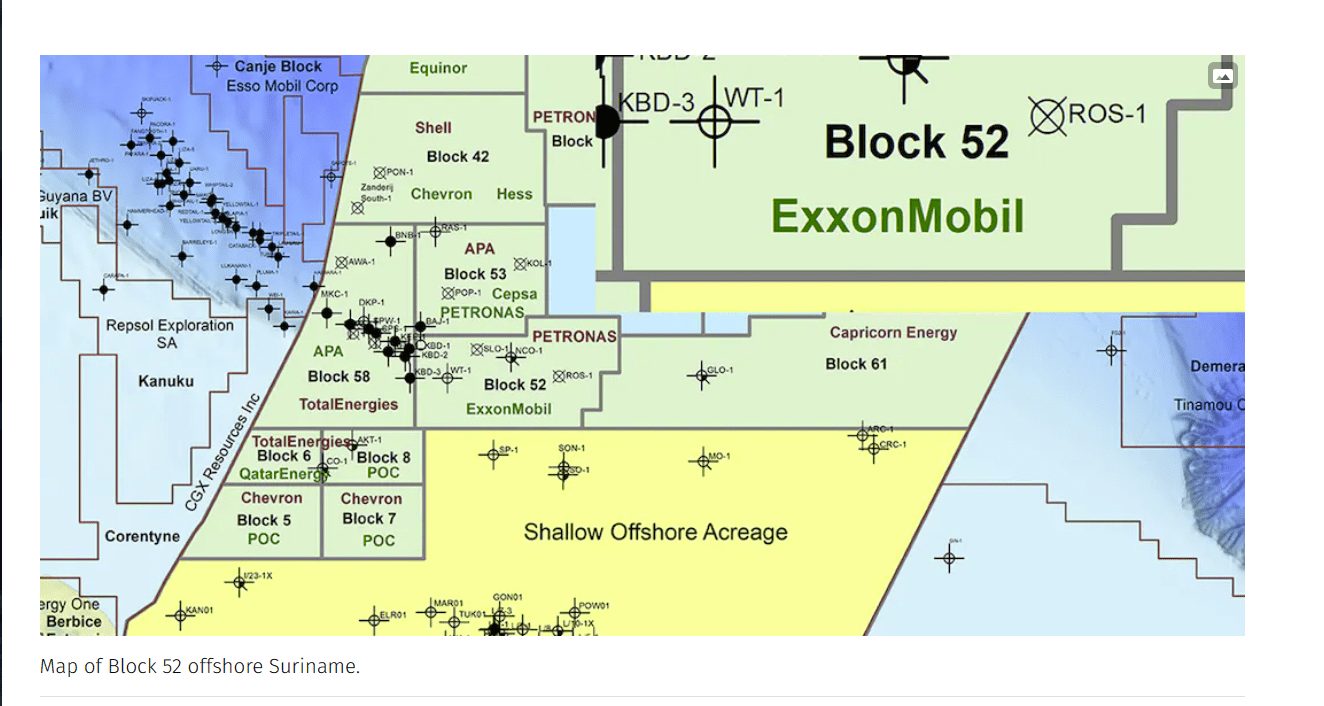

The discovery of Petronas in Suriname has the potential to double the number of basin development projects for Exxon Mobil Corporation. Suriname supports the oil and gas industry and has no active border disputes. Exxon Mobil and its partners can develop multiple FPSO projects simultaneously if needed. A second partnership discovery makes it very likely that basin production growth will become significant for Exxon Mobil. The market values the discoveries in Suriname and Guyana because there is cash flow from operational FPSOs in Guyana.

ExxonMobil Corporation has been developing the discoveries in Guyana for some time. That is likely to continue, as Guyana has very strong allies who want to keep Guyana as it is now. In the meantime, it seems that Petronas has found enough oil in partnership with Exxon Mobil to put Suriname very high on the list of priorities for the foreseeable future. Together, these two countries represent a lot of growth potential, even for a giant like Exxon Mobil. It will take a few years for the money to start rolling in. But once that happens, it’s likely to be very significant for the partners.

Suriname

Suriname was a Dutch colony and is now an independent country. The government supports the oil and gas industry because it will bring in foreign currency that the government can use in its budget. Unlike neighboring Guyana, there are little to no active border disputes. Therefore, the development of oil and gas in this country will be much less hampered than it may be in neighboring Guyana.

The Announcement

For those unfamiliar with Petronas, Petronas is a government-owned Malaysian company with several public subsidiaries. Petronas is very large and responsible for a significant portion of the government’s revenue. Both companies in this partnership, Petronas and Exxon Mobil, bring a lot of experience and resources “to the table.”

What this discovery means for Exxon Mobil shareholders is that the discoveries are very likely to expand the Guyana oil fields into Suriname for one large project (appropriately split between the two countries).

Of course, more wells need to be drilled, but just like in Guyana, many wells are found with oil and there are not too many dry wells according to the current trend. At the moment, there seems to be a lot of upside potential (with multiple FPSOs in operation) that needs to be further spared in the future. As with any forecast, there are the usual risks for offshore upstream to achieve that ultimate production goal.

Many investors claimed that the current pace of development in Guyana was not really significant for a company like Exxon Mobil. But as more leasing areas discover oil, there will be multiple development projects that will be significant for Exxon Mobil in total. This discovery is likely the most visible step in that development for shareholders, as the discovery clearly appears to be on another lease with significant upside potential.

With each discovery, dry wells can be found “tomorrow” with no more successes ahead. Although that result seems minimal at the moment, it is worth keeping in mind, because at some point this pelvis will have boundaries.

The Golden Mile

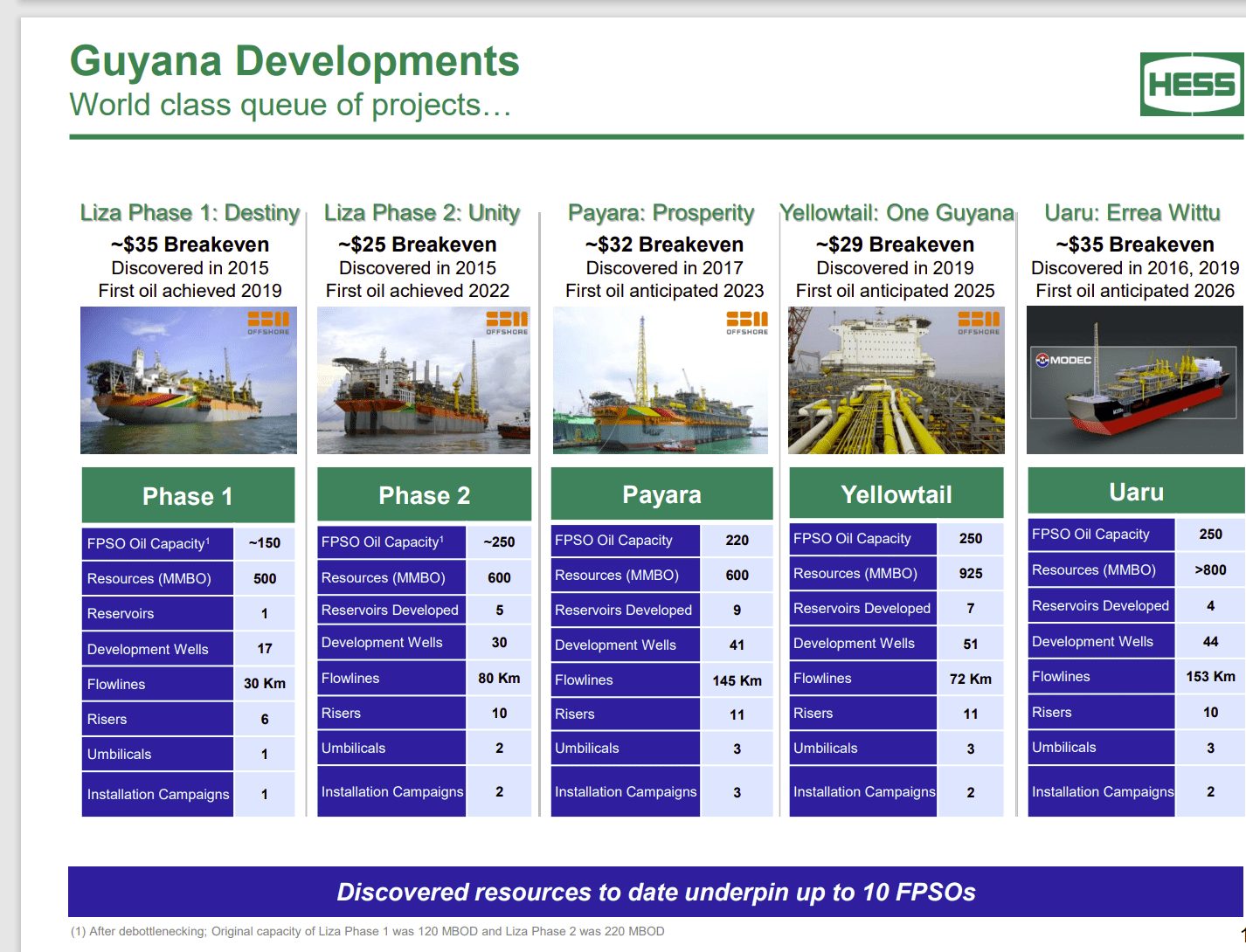

The market is hoping for a giant expansion that can produce results similar to what is happening in Guyana:

Exxon Mobil is the operator in Guyana. Because the Guyana project is a few years ahead of its discovery in Suriname, there is now some industry nearby that will help facilitate the development of the oil industry in Suriname. Exxon Mobil had to start “from scratch.” But now, a discovery that might not have been commercial is more likely commercial with existing production nearby.

If the Guyana company does not help the situation, the discovery on the Total block shown above is also available. With the number of discoveries piling up in Suriname, the hope is that the industry will be as big as what seems to be happening in the Guyana company.

As a result, the rumors have free rein. However, it must be said again that the “party may be over tomorrow”. That’s always the risk with any discovery. However, it looks much more likely that the Suriname business will be a significant addition to the Guyana business, with potentially equally large upside potential.

The other thing is that Wall Street sees a lot of profit potential in Suriname. But the profit parameters have not really been discussed yet by any operator in Suriname. In fact, that discussion is probably still a few years away. There are many profitable scenarios from the discoveries in Suriname so far that are commercially viable but may not match what is happening in Guyana. So Wall Street may potentially be disappointed with the relative profitability of Suriname wells, although large projects are feasible. We just don’t know yet.

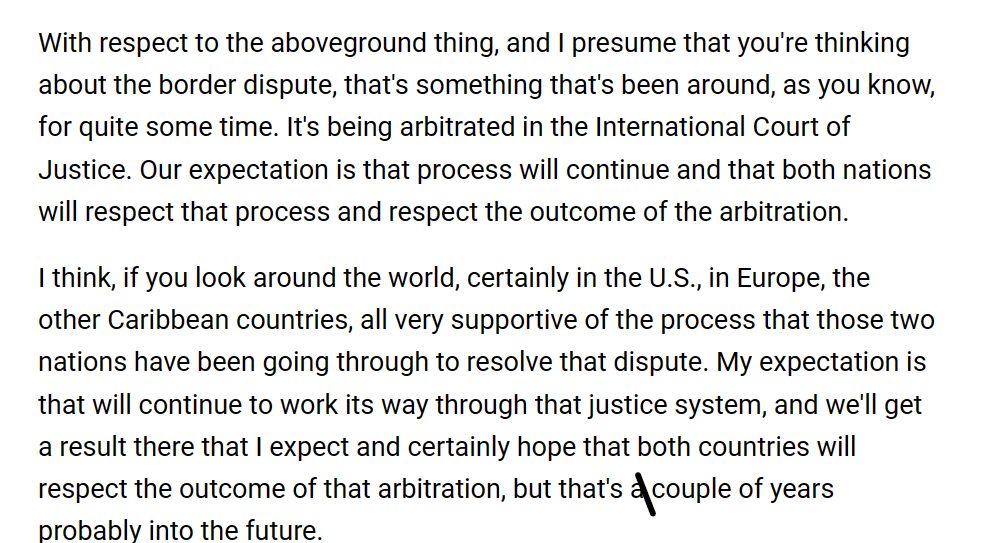

Dispute over the border of Guyana The dispute over the border of Guyana is very unlikely to affect the offshore business in Guyana, let alone the offshore business in Suriname. Guyana has too many supporters like Brazil who would likely quickly put an end to adverse outcomes. The United States also currently has a presence in Guyana.

Here is a statement from Darren Woods, CEO and chairman of Exxon Mobil, on the situation:

It is very unlikely that Venezuela will gain control of the industry in Guyana. If that small opportunity arises, it could slow down the development of the Suriname industry. But it would not prevent the development of the industry.

Whenever there is existing oil and gas infrastructure, there is usually some development assistance available for the next set of discoveries. Thus, Suriname would likely be able to start production sooner than was the case in Guyana, where the partnership with Exxon Mobil was the first.

The public interest In a way, this discovery diversifies the country risk for what is going to be a very large project, even for Exxon Mobil. Even large companies don’t want to be too dependent on one area.

The discovery, in the eyes of many, has the potential to double the existing business. Exxon Mobil and its partners are more than capable of handling the start-up of two or more FPSOs at the same time. The good news is that Exxon Mobil and its partners can easily handle a large project like this with large upfront costs.

As the slide from Hess’s presentation above shows, there are a lot of costs associated with a producing FPSO. However, there are still more costs to do to make sure that the first FPSO is even necessary. While that seems likely to many, it’s far from assured until the operator has completed all the necessary due diligence.

Nonetheless, discoveries like these keep the market excited now that there is cash flow from one project. For a long time, the market did not pay attention to the events in this area because no project had positive cash flow. Of course, that has now changed, where the market sees at least some potential.

The more of this basin is developed, the more likely it is that there will be a market reaction to later discoveries of pelvic extensions. So far, this cymbal has world-class low break-even points. That great profitability can decrease as you get closer to pelvic boundaries. But right now, this basin is in the “build-up phase” of excitement, even for a company as large as Exxon Mobil.

Date: 30 December 2023

Advertentie

Wilt u uw merk hier tonen?

Maak contact en ontdek de advertentiemogelijkheden!

Wilt u uw merk hier tonen?

Maak contact en ontdek de advertentiemogelijkheden!

– DISCLAIMER –

LocalContentSuriname.com is een portaal waar ondernemers, bedrijven en stichtingen zich willen presenteren. Deze website is niet verantwoordelijk voor de inhoud die op deze pagina getoond wordt. Alle informatie die op deze pagina wordt verstrekt, moet onafhankelijk worden geverifieerd. Er worden geen garanties of verklaringen gegeven voor de juistheid van de informatie. Ga naar veelgestelde vragen voor meer informatie.