World Bank: Suriname Key Conditions and Challenges

Local Content Suriname

Suriname built up macroeconomic imbalances because of high commodity revenue volatility and economic mismanagement. The pandemic exacerbated existing domestic vulnerabilities, leading to a sharp GDP contraction, increased unemployment, and high inflation which created an increase in poverty. A newly elected government adopted a comprehensive IMF-supported macroeconomic stabilization program. While Suriname’s economy is now showing signs of stabilization, poverty remains elevated, and could be alleviated by stepping-up plans to improve delivery and targeting of social assistance.

Key conditions and challenges

Suriname is a small, natural-resourcerich, upper-middle-income country. Gold currently represents more than 80 percent of total exports and the overall mining sector accounts for nearly half of public sector revenue. The government redistributes revenue earned from extractive industries through significant public sector employment, price subsidies, and through mostly categorically targeted income support to people with disabilities, households with children, the elderly, and vulnerable households.

Suriname is slowly recovering from a severe fiscal and balance of payments crisis, exacerbated by the COVID-19 pandemic. Substantial macroeconomic imbalances built up after a sharp decline in commodity prices (2015-16) and the run-up to the 2020 general elections. A widening fiscal deficit led to a rapid accumulation of debt as well as monetary financing, which eventually resulted in surging inflation, a large depreciation of the exchange rate, and a near-exhaustion of international reserves. Recent internationally comparable poverty statistics are not available for Suriname. Data collected in 2016 suggested that over a quarter of the population was not able to meet basic food and non-food consumption needs. Consumption poverty was markedly higherin the interior of the country.

Micro-simulations suggest that employment losses induced by the economic downturn, combined with a loss in purchasing power stemming from high levels of inflation, led to a substantial increase in poverty rates. Women, especially those who were single and those with lower levels of education, were more likely to be poor pre-pandemic and more heavily affected by the economic downturn.

The government adopted a comprehensive program of policy measures with respect to fiscal and debt sustainability, monetary and exchange rate policy, financial sector stability, and governance to address macro-economic imbalances as of mid-2020. On December 22, 2021, the IMF board approved a three-year Extended Fund Facility in support of this program.

Recent developments

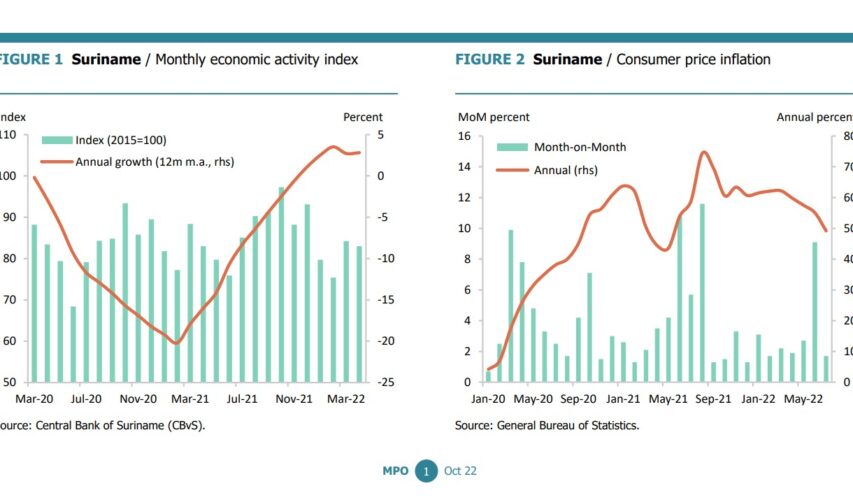

Suriname’s economy is now starting to show signs of stabilization and a modest recovery. Economic activity, as measured by the 12-month moving average of the Central Bank’s Monthly Economic Activity Index (MEAI), is posting modestly positive rates of growth as of December 2021 after two years of moving in negative territory (Figure 1). Annual inflation, while still high, is starting to come down with its latest print last July at 49.2 percent (Figure 2).

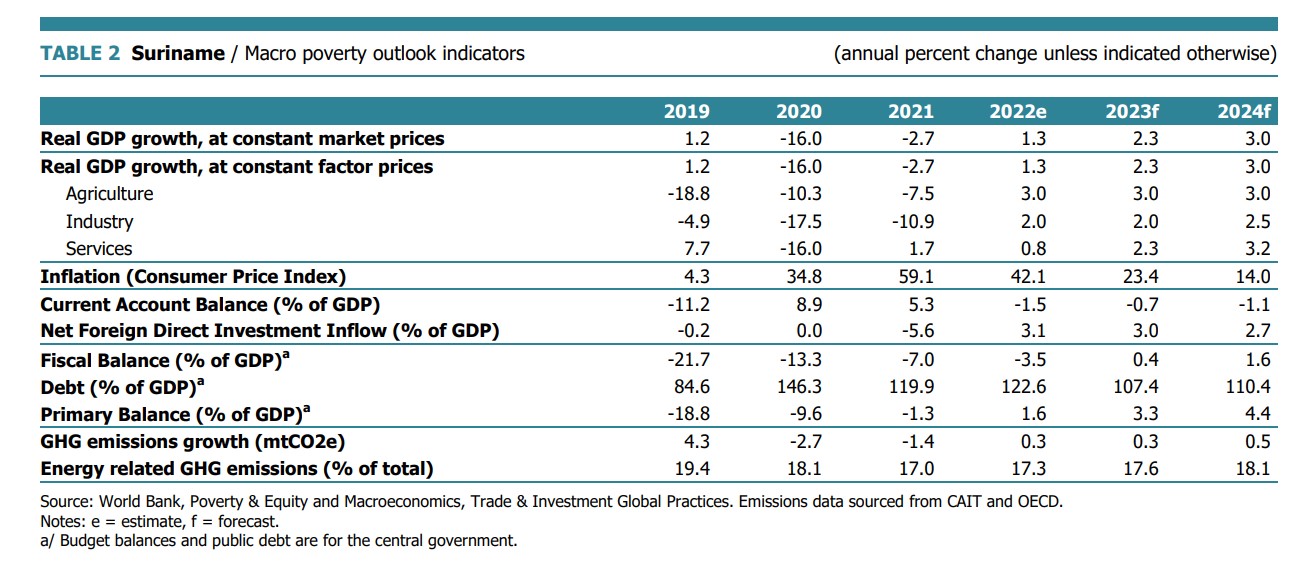

The exchange rate, which has been reasonably stable since the introduction of a flexible exchange rate in June 2021, showed significant weakening as of June 2022. The recent sharp depreciation of the nominal exchange rate mitigates appreciation of the real exchange rate, though also feeds into higher consumer price inflation. Exchange rate depreciation contributed to a significant shift in the current account of the balance of payments: from a deficit of 11 percent of GDP in 2019 to a surplus of 9 and 5 percent of GDP in 2020 and 2021, respectively. The current account turned into a modest deficit again in the 2ndquarter of 2022.

Public debt amounted to US$3.4 bn or 125 percent of GDP at the end of 2021 and arrears on external bilateral and private market debt are estimated at about 11 percent of GDP. Restoring debt sustainability under the IMF-supported program will require debt relief from Suriname’s private and bilateral external creditors. Suriname successfully reached an agreement to restructure its external debt owed to Paris Club bilateral creditors (US$ 119m, including arrears) under a two-stage debt treatment. The first phase includes a reprofiling of maturities falling due between 2022-2024, while the second phase envisages a rescheduling of debt repayment due after December 2024 and is conditioned on comparability of treatment with other external creditors and the continuation ofmacroeconomic policies consistent with debt sustainability. Existing arrears (up to end-2021) will be repaid in two installments in 2022 and 2024.

Revenue enhancing and expenditure reduction measures have significantly reduced the country’s primary fiscal deficit. Additional measures, such as the introduction of a Value Added Tax, the elimination of electricity subsidies, and the rationalization of civil service, should turn the primary balance from a persistent deficit into a surplus of 3-4 percent of GDP by 2023-24. The government managed to pass legislation for the introduction of VAT as of January 1, 2023, at a general rate of 10 percent. The introduction of VAT makes up an important part of the fiscal adjustment. Although the economy is stabilizing, poverty rates are likely to exceed pre-crisis levels. Social assistance spending remains low at about 1.3 percent of GDP. And increases in social assistance payments are not expected to fully offset declines in disposable household incomes that were brought about by declines in employment and rapid inflation. Imported inflation is putting poor and vulnerable households further under strain.

Unusual for Suriname, popular protests reflecting dissatisfaction with the current situation in the country broke out in July. Protesters expressed their dissatisfaction with failing public health care, continuing high inflation, and especially rising fuel and electricity prices. They demanded an immediate end to fraud and corruption. The protests faded after a government response acknowledgedprotestors’ concerns.

Outlook

Suriname faces challenging social and economic conditions. The near-term outlook critically depends on the successful implementation of the macroeconomic stabilization program. After two years of sharp contraction in economic activity, a gradual resumption of economic growth is expected for 2023-24 to nearly 3 percent per year in the medium term.

The longer-term growth outlook may be more positive following the discoveries of several offshore oil deposits as of 2020. A Final Investment Decision (FID) by one of the major oil companies is expected early next year at which point there will be more certainty about a possible revenue flow from offshore oil production which will take several years to materialize. The modest economic recovery is not expected to fully counterbalance the significant challenges faced by many households. Labor market indicators are not expected to return to their pre-pandemic level any time soon and inflation remains high, with continued negative implications for poverty. Planned efforts to improve the delivery and effectiveness of social assistance, therefore remain a priority.

Date: 19 februari 2023

Advertentie

Wilt u uw merk hier tonen?

Maak contact en ontdek de advertentiemogelijkheden!

Wilt u uw merk hier tonen?

Maak contact en ontdek de advertentiemogelijkheden!

– DISCLAIMER –

LocalContentSuriname.com is een portaal waar ondernemers, bedrijven en stichtingen zich willen presenteren. Deze website is niet verantwoordelijk voor de inhoud die op deze pagina getoond wordt. Alle informatie die op deze pagina wordt verstrekt, moet onafhankelijk worden geverifieerd. Er worden geen garanties of verklaringen gegeven voor de juistheid van de informatie. Ga naar veelgestelde vragen voor meer informatie.